Newmont Mining has rejected Barrick Gold’s takeover offer, suggesting a joint venture project instead.

Barrick proposed an all-stock negative premium proposal to acquire Newmont in February.

Newmont said its recent move to acquire Goldcorp presents more value for the company and its stakeholders.

“Our thorough review of Barrick’s unsolicited proposal and its associated risks has reaffirmed our conclusion that the combination of Newmont and Goldcorp represents the best opportunity to create value for Newmont’s shareholders and deliver industry-leading returns for decades to come,” said Gary Goldberg, Newmont’s CEO, in a March 4 news release.

“Unlike Barrick, Newmont Goldcorp will be centered in the world’s most favourable mining jurisdictions and gold districts. The combination with Goldcorp is significantly more accretive to Newmont’s shareholders on all relevant metrics compared to Barrick’s proposal, even when factoring in Barrick’s own synergy estimates.

“Realizing value through Barrick’s proposal for Newmont’s shareholders hinges entirely on a new management team that lacks global operating experience and is only two months into its own transformational integration.”

Denver-based Newmont announced its intention to acquire Goldcorp, creating a new company, Newmont Goldcorp, in January.

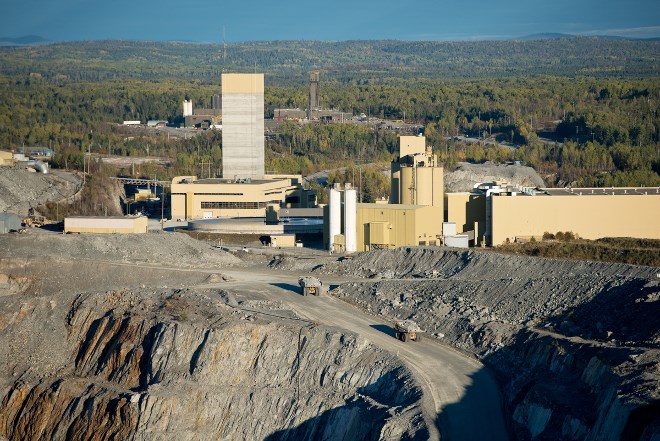

In Northern Ontario, Goldcorp owns and operates Porcupine Gold Mines in Timmins, which comprises the Hoyle Pond underground mine and the Hollinger open-pit mine; Musselwhite Mine, a fly-in complex located 500 kilometres north of Thunder Bay; and the Red Lake operations, which include the Red Lake and Campbell underground mining and processing complexes.

Toronto-headquartered Barrick has gold operations in multiple locations worldwide, including the underground and open-pit Williams Mine at the Hemlo Camp, located about 350 kilometres east of Thunder Bay.

In lieu of an acquisition, Newmont instead is proposing a joint venture to combine Newmont and Barrick’s Nevada-related operations.

Under the proposal, Barrick would hold an economic interest of 55 per cent, while Newmont would hold a 45 per cent economic interest. On the management side, Newmont and Barrick would have an equal number of representatives on the management and technical committees and decisions would be made by majority vote. Any operational management would be jointly appointed by both companies and be responsible for day-to-day management.

“We are confident that Newmont’s demonstrated technical expertise and consistent execution will be critical in realizing the synergy opportunities of the proposed joint venture,” said Tom Palmer, Newmont’s president and COO.