The Toronto owners of a northeastern Ontario cobalt refinery are talking about a physical expansion of their dormant plant to be the exclusive supplier to the North American electric vehicle market.

First Cobalt released its much-anticipated feasibility study of the former Yukon refinery that they bought three years ago, just outside the town of Cobalt.

"This is a mining story that's turned into a chemical story," said company president-CEO Trent Mell in a May 4 conference call to analysts and investors.

The junior miner-turned-refiner startup has the only permitted facility in North America capable of processing cobalt hydroxide feed shipped in from offshore into a highly pure cobalt sulfate, used in manufacturing lithium-ion batteries.

Mell and his management team mapped out the road ahead for 2020 in what stands to be a pivotal year for the company as they seek to position the hydrometallurgical refinery as a toll processing operation for global mining companies.

Chinese refiners currently control almost 80 per cent of the world's finished cobalt product, followed by Japan and Finland. First Cobalt believes they can cut a five per cent slice of that refined market.

Want to read more stories about business in the North? Subscribe to our newsletter.

Mell said Western car manufacturers have a strong appetite to see a domestic processor to shorten their supply chains.

The key to moving the project forward in 2020 is wrapping up a commercial agreement with Glencore to start supplying the refinery with raw cobalt feed from the Democratic Republic of Congo.

The international base metal mining giant funded the refinery restart study.

First Cobalt also needs an amendment to their provincial closure plan permit and three environmental approvals that will allow them to increase production from 12 tonnes per day to 55 tonnes per day by late 2021.

It would allow them to expand the refinery over a 12-month construction period. Work could begin by this fall.

"This is a shovel-ready project," said Mell. "We could be going very quickly."

The refinery was built in 1996 and placed into care and maintenance mothballs in 2015 when the previous owners ran out of money.

The plant's biggest drawback was that it was a small batch producer, doing intermittent custom orders. But it's perfect to process a specialty product like cobalt sulfate.

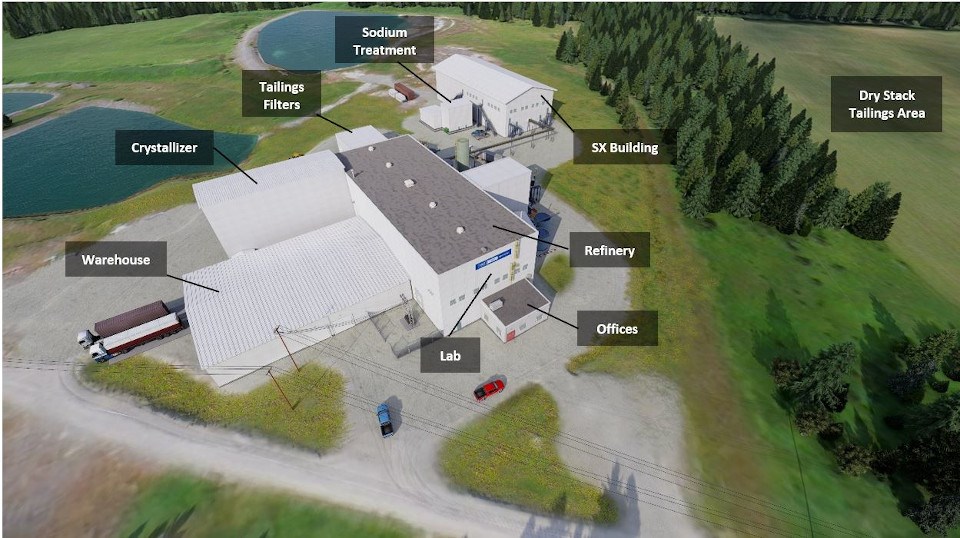

With 120 acres at their disposal, the company wants to keep all new construction within the confines of the property.

They want to build a separate building, housing a new sodium treatment facility, while grafting two smaller additions onto the main building.

There's ample room on site (about 80 acres) to drystack tailings for 17 years, with two settling ponds to collect any runoff.

The refining process would involve drawing water from Lake Timiskaming. The company is making assurances that all treated water will "meet or exceed" current regulatory requirements before being released back into the environment.

First Cobalt also hopes to begin working with potential clients in providing test samples as a a precursor to striking off-take agreements with North American battery makers.

They're looking to fine-tune some variable costs on the processing side and assess other technologies to shave some dollars off the restart budget.

Financing arrangements to recommission the plant could come from Glencore, other interested cobalt mining companies, and government agencies.

According to the feasibility study, the refinery would generate $37 million in revenue – before taxes – for the first year of production.

Down the road, First Cobalt wants to use this toll processing operation as a revenue generator to fund its exploration properties south of the town of Cobalt and in Idaho.

The company said they will release an action plan detailing development and the timelines within three months.