The onset of true economic recovery is still six to seven months ahead, said Export Development Canada's chief economist Peter Hall.

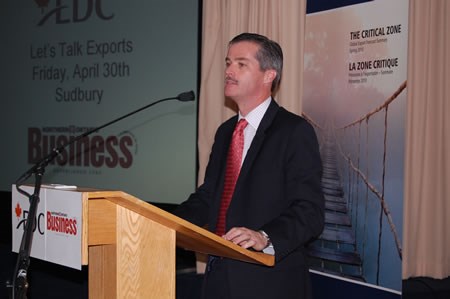

On April 30, Hall spoke at a breakfast meeting in Sudbury titled The Critical Zone. He shed some light to a group of local business people as to where the world is at in terms of its economic cycle. As much as it appears that recovery is on the upswing, Hall cautioned that “we are not there yet.”

“There is a large difference between a return to growth and the onset of recovery,” he said, warning that we are still operating 10 to 11 per cent below the levels we saw at the end of the last cycle.

He attributed the lower performance levels to the fiscal stimulus programs, which obscure true economic growth. One of the leading indicators is the housing market, which Hall described as “deeply stuck in the mud.”

By using the housing market as a benchmark to true recovery, Hall predicted a tenuous six- to seven- month time frame before a real recovery occurs. It is that in-between time – the end a recession and beginning of a recovery – that leaves businesses vulnerable.

He stated five concerns that can be a threat during this time, prefacing it with a high probability that we'll get through this period of time unfettered.

The first risk is fiscal policy itself and the imminent threat of the maturation of huge stimulus measures. He anticipates growth will slow because we are at the end of the growth phase, and slowness will undermine confidence in the economy.

Financial markets are a second key risk. When financial markets were crippled in the fall of 2008, aggressive measures were taken to return the sector to profitability, which have proved successful, but until a true recovery has happened, there is still uncertainty in the markets. Additionally, the threats of sovereign defaults occurring in Greece, Portugal and Spain could be punishing for a financial system that is trying to regain momentum. As well, the costly re-regulation of financial markets has to be done before a true recovery begins.

“This is a period that is usually the greatest testing point for financial institutions inside of an economic cycle,” Hall said. “We're watching those financial institutions very carefully. They are critical to the international economic system.”

The third key risk is commodity prices. The low levels of activity in the world don't match up with the high commodity prices and rising inventories of key base metals and crude oil. Normally, those two things don't happen at the same time. Thus, speculation is driving commodity markets. Hall said it isn't supportable and that there will be a price correction in the second half of the year.

The fourth risk is rising interest rates, which is a reactionary measure to clamp down on inflation. Hall predicted that as the economy softens in the second half of this year, the interest rate pressure will cool and we'll see a more measured rate.

Protectionism is the fifth risk, which can destabilize an overall growth picture to a global economy.

Hall described those five key risks as a rickety rope bridge spanning a ravine and one we must cross to arrive at a brighter side where stable recovery and growth can begin.

“We are almost there, and if we can make it through this period of time, and we believe that we will, we will all be that much better off for it.”

As we step out of the dark depths of recessionary times, some local mining suppliers are experiencing recovery.

Walden Equipment's marketing director Sarah Crocker said the business has doubled its growth since it has expanded to international markets. Walden Equipment is part of the Walden Group of Companies that sells and leases new and used mining equipment. It also services, leases and sells remanufactured and refurbished equipment.

She said the business has plans to use the EDC to ensure financial protection of an equipment sale to a new client in Brazil.

Mike Malkoski, president of MWM Instrumentation and New Equipment Ltd. and local mining supplier of specialty pumps, said the EDC has been a great help to his company over the years.

“The rates are ridiculously low and EDC covers it (the equipment) from the first nut and bolt to the end point.”

With 95 per cent of his business involved in exports, Malkoski said EDC covers 50 per cent.