Those who have been in mining for any length of time realize that exploration is literally hit or miss.

The trained eye can find best bets, but even then nothing is guaranteed. So why not spread out the net – and the risk – over many different targets?

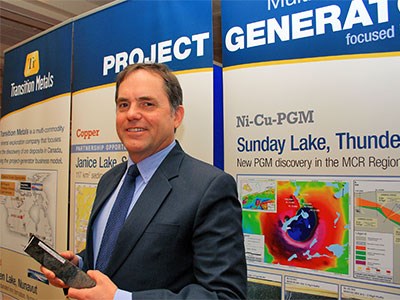

That’s part of Transition Metals’ (TSX.V – XTM) strategy. In fact, the company currently has 27 properties in various stages of exploration.

“All of our projects have the opportunity for significant discovery,” said Transition Metals president and CEO Scott McLean. “The ones that we don’t see that on, very quickly we are able to… let those drop. It’s a continuous process of bringing projects into the company.”

The ones that do have potential move to the next level, partnering with other companies for further drilling.

However, what’s not in Transition Metals’ operational plan is actually building a working mine.

Using what it calls a “project generator” model, Transition Metals would relinquish interest in the property to its partners before that point for cash, stock, and/or other considerations, but often aims to retain a minority interest in the property.

The model is designed to maximize shareholder value, McLean said, allowing the company to realize its profits earlier and mitigate risk by engaging partners.

“After you’ve discovered something and you’re actually building, going through feasibility, and then into commercial production, that’s where all the value of the company is really built, all the asset value,” McLean said.

“But the share price never, ever seems to get as high as it did back when you had a discovery. That’s when you really get the skyrocketing prices over the short term.”

It’s also the riskiest part of the operation. The project generator model mitigates part of that risk by choosing many potential targets in the hopes that the winners outweigh the losers, at least in terms of investment.

Partnering with other companies is another way to lessen that risk as well as reduce dilution of stock, something junior mining companies are prone to when raising capital, especially in down markets. Transition Metals actively seeks partners on all of its projects.

“It’s actually a pretty good model when we’re in the bottom of the market right now because we’re not having to go out and raise funds at very low valuations and strongly dilute the company,” McLean said.

The company’s technical strategy to develop targets uses a state-of-the-art geosciences database, McLean said.

McLean added that with the sector downturn, it’s a great time to buy properties.

It doesn’t hurt that the company has two award winners in McLean and chief geophysicist Kevin Stevens, who were co-recipients of the PDAC Prospector of the Year Award in 2004 for the discovery of the Nickel Rim South mine in Sudbury.

With Transition Metals, they also won the Northwest Ontario Prospectors Association’s Bernie Schneider Discovery of the Year Award along with their partner Impala Platinum Holdings (Implats) last year thanks to their platinum discovery at Sunday Lake, 25 kilometres north of Thunder Bay. It is one of their most exciting projects – and the perfect example of the project generator model at work.

“The discovery was 100 per cent funded by Implats, and they continue to carry us for a 25 per cent interest (in the project) through to completion of a bankable feasibility study,” McLean said.

Another project, its Aer-Kidd property in Sudbury, McLean describes as “one of the better exploration projects on the planet.”

Situated along the Worthington Offset Dyke between Vale’s Totten mine and KGHM’s Victoria mine, it is being drilled by Transition Metals’ partially owned subsidiary, Sudbury Platinum.

Its Haultain gold project in Abitibi (described by McLean as a “Kirkland Lake lookalike”), its Janice Lake copper project in northern Saskatchewan, and its exploration in the Far North with partner Nunavut Resources Corp. are also possible near-term successes for the company.

That potential is not yet reflected in its stock price, which McLean said is undervalued at the moment along with that of many other junior mining companies.

“We are in the absolute pit of the bear market right now for our industry,” McLean said. “Everybody should be filling their boots, not just with our stock, but with other (juniors). You don’t need all of them to be successful, you need one of them to be successful.”