A Chinese mining investor is eyeballing a string of rare earth metal properties in Northern Ontario for a potential development partnership opportunity.

Sinomine Resource Group of Beijing has signed a letter of intent (LOI) with Power Metals Corp. of Vancouver to finance and develop three properties containing cesium, lithium and tantalum elements near Cochrane, Dryden and Kenora.

Power Metals owns three of the five cesium occurrences in Ontario.

The properties involved are Case Lake, 80 kilometres east of Cochrane; Paterson Lake, 60 kilometres north of Kenora and close to Avalon's Separation Rapids lithium property; and Gullwing-Tot Lakes, 30 kilometres northeast of Dryden.

Power Metals has been looking for a development partner since starting a strategic review last January on how to best maximize the value of its mineral assets, including discussing the option of selling its properties.

Want to read more stories about business in the North? Subscribe to our newsletter.

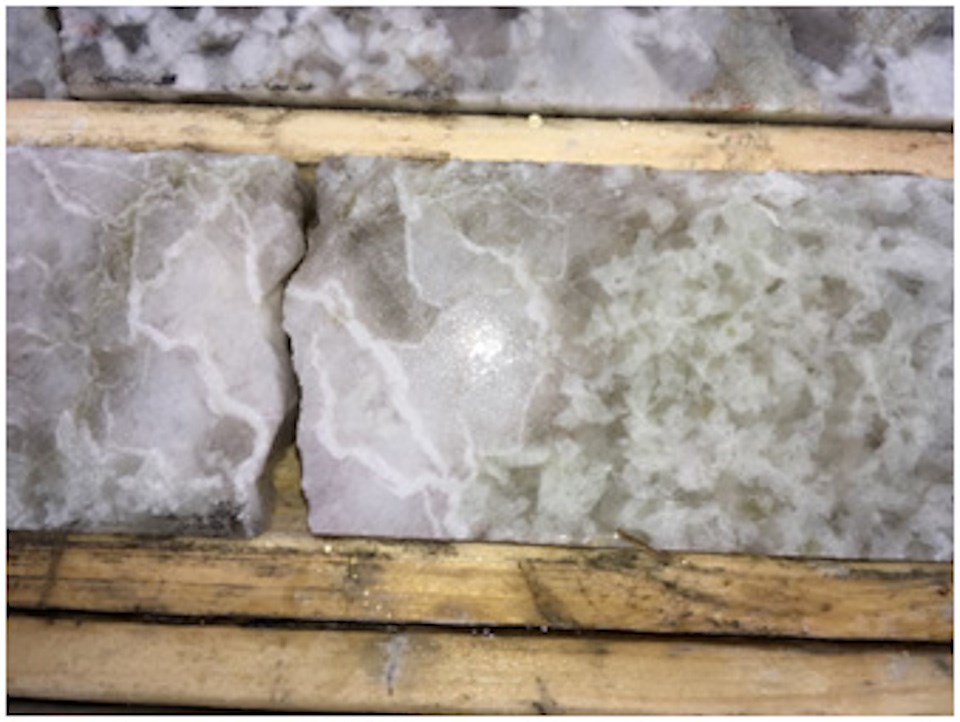

The principle focus is on the high-grade cesium mineralization found in the host spodumene pegmatite rock at Case Lake, a 95-square-kilometre property, near the Quebec border.

Cesium is an extremely rare commodity and is considered a critical mineral by the U.S. government, as are lithium and tantalum.

Cesium is used for the GPS in the cell phones, in atomic clocks, and as a lubricant in oil drilling.

There are only three cesium mines in the world, and Sinomine has one of them.

Last year, a Sinomine subsidiary company acquired the Tanco lithium, cesium and tantalum mine from Cabot Corporation. The operation is 180 kilometres northeast of Winnipeg, close to the border with Ontario where the pegmatite formation there has been mined there since the late 1960s.

The LOI outlines the possibilities of Sinomine financing Power Metals' exploration efforts through either direct investment or through a joint venture agreement.

“Every shareholder should share in our excitement on this major development for Power Metals (PWM)," said company chairman Johnathan More in a Sept. 8 news release.

"Sinomine are industry giants for producing and processing cesium, lithium and tantalum. We now look forward to the next steps in developing our assets jointly with Sinomine and also the potential joint development of Sinomine’s Canadian assets. I want to thank our team for this significant accomplishment as well as the opportunity presented by Sinomine.”

Wang Pingwei, Sinomine's chairman and president, is interested to see if this cooperation agreement will bear fruit.

"Sinomine’s goal is to find further mineral resources for commercial mining other than Tanco, such as cesium, lithium, etc, through this strategic partnership with PWM."

Sinomine Resource Group is engaged in exploration, mining investment and base metal chemical manufacturing.